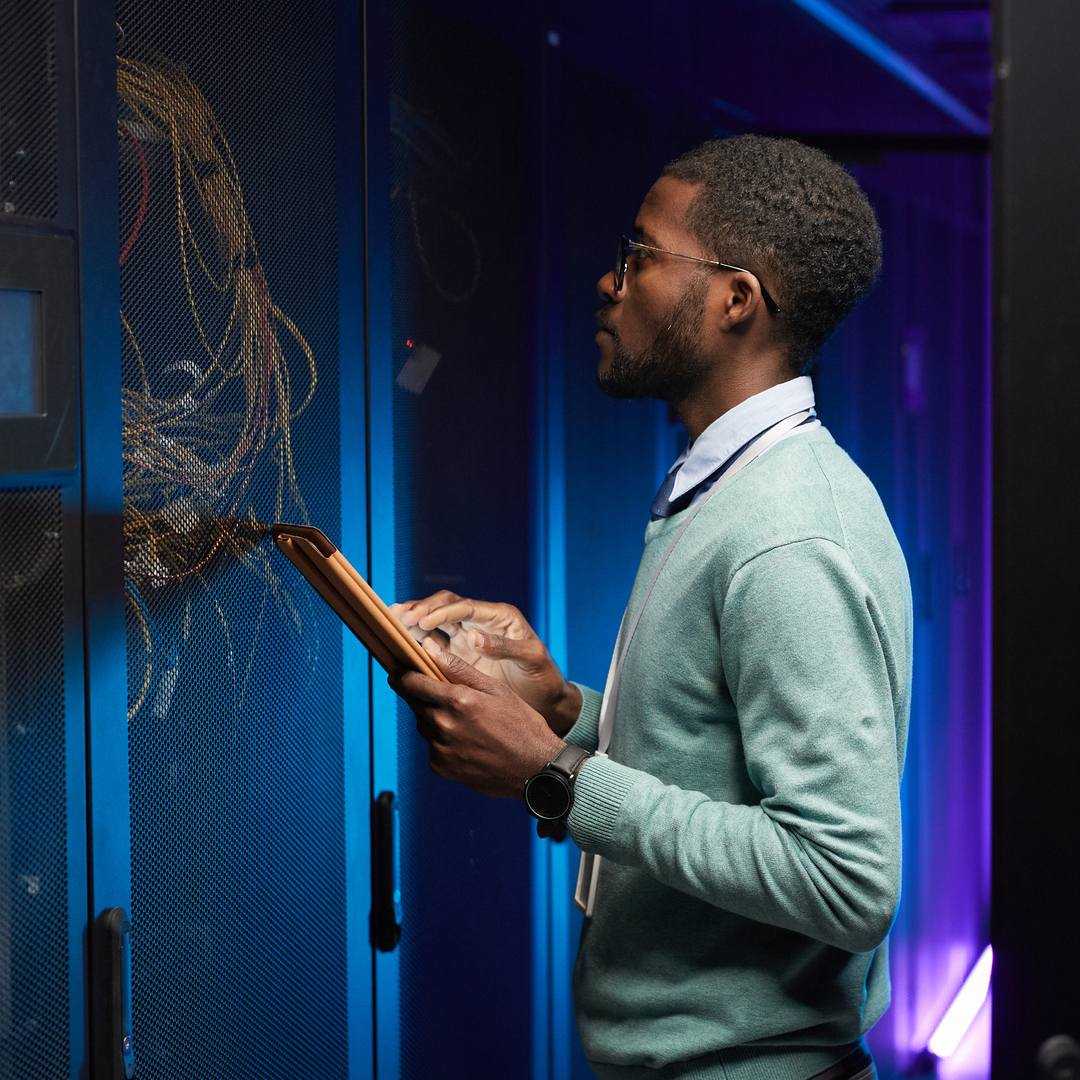

PCI Compliance Consulting Services Atlanta, GA

Payment Card Industry (PCI) Data Security Standard (DSS) obligations are important to small and mid-sized businesses. We help you understand and meet these PCI DSS obligations.

PCI DSS Consulting Services in Atlanta Metro

Reaching PCI DSS compliance as a small business can be difficult and stress-inducing since violations are costly. Our PCI Compliance consulting services in Atlanta prepare you to take payments online and in-store without the anxiety of dealing with technical complications or expensive non-compliance penalties.

What Is PCI Compliance?

Being PCI compliant means a company or organization is compliant with the Payment Card Industry Data Security Standard which is a standard that was created to better control cardholder data and reduce credit fraud. This standard is administered by the Payment Card Industry Security Standards Council which was formed and is administered by the major card brands.

Validation of compliance is performed periodically by a method suited to the volume of transactions handled.

How IntegriCom Helps With PCI Compliance

IntegriCom is a qualified and knowledgeable IT managed service provider with a certified CISSP on staff. Our engineers are very experienced in network security including the specific areas of PCI compliance. We have implemented countess firewalls and other network security measures such as security policies creation, proper vendor equipment and software configurations, data encryption, network segmentation, and access logging. With our security assessment, we can drill directly to the areas that need attention and get you fully compliant. With us on your team, you can rest assured that you will have covered all the requirements of PCI compliance, and this compliance can be maintained through our managed IT services.

PCI DSS Assessment

IntegriCom provides an assessment to find out if you are PCI compliant, or what you would need to do to be compliant. Our assessment gives you a detailed capture of PCI compliance for your business and how to maintain compliance. Give IntegriCom a call today to learn more.

PCI Remediation Program Design

Based on the assessment results, IntegriCom puts together a remediation plan to get your organization PCI compliant. Not only do we put together a remediation plan, but also work with you to execute that plan. IntegriCom makes it easy to get your business PCI compliant.

PCI Program Management

With IntegriCom’s managed IT services, you get a management program that keeps your organization compliant by maintaining proper network security, keeping up with and adjusting to network changes, and staying on top of compliance rules and keeping policies up-to-date.

PCI Incident Response Plans

Security policies and plans are important and are foundational things that any organization should do. This includes an incident response plan, and specifically a PCI incident response plan. At IntegriCom, we help our managed clients with plans creation and maintenance. We understand the plans’ structure, what needs to be included, and how the organization should communicate and use the plan.

PCI DSS SAQ Validation & Support

The PCI DSS self-assessment questionnaires (SAQs) are validation tools intended to assist organizations in reporting the results of their PCI DSS self-assessment. IntegriCom helps businesses understand the SAQs that apply to their specific business and helps with the completion and submittal of the self-assessment. Contact us today to learn more about PCI DSS SAW validation and support for your organization.

PCI Report on Compliance (RoC)

A PCI Report on Compliance (RoC) is issued by a Qualified Security Assessor (QSA) and details a company’s security posture, environment, systems, and protection of cardholder data. The RoC is developed through an assessment completed by a QSA and includes an onsite audit and review of controls. After the tests of your controls and documentation of your processes, a summary is produced which culminates in a final RoC.

Why PCI Compliance Is Important

PCI compliance provides a security standard for merchants, and it protects card holder data and reduces the risk of data breaches.

It provides client protection and improves their confidence. It can increase operational efficiency and reduce the cost of a breach by avoiding fines and lawsuits.

The IntegriCom PCI DSS Compliance Process

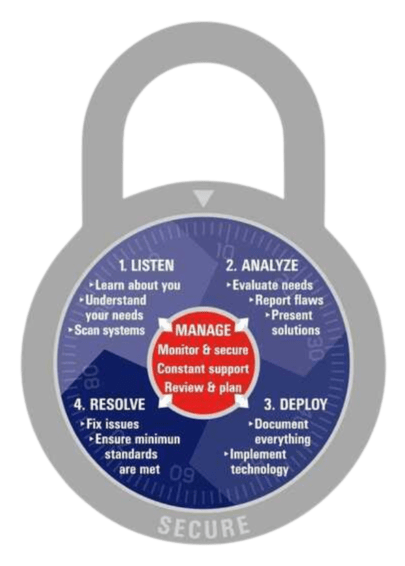

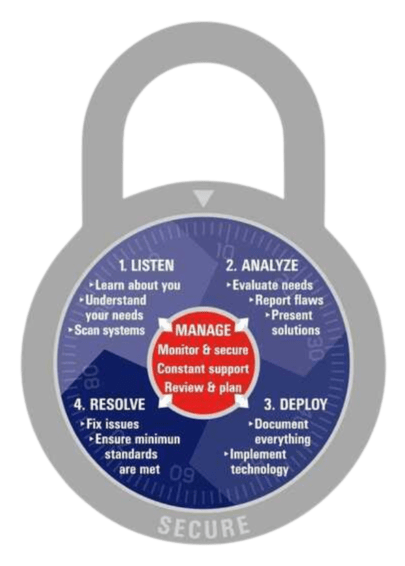

IntegriCom has a Proven Process that is used for all client engagements including PCI compliance work. And becoming PCI compliant is in sync with our IT managed services. The requirements are just good practices in general that we recommend all clients adhere to.

PCI compliance requirements are important for any company, but certainly for companies that are processing card payments. Not complying can be painful and expensive. The requirements may seem daunting and complex but hiring an experienced and knowledgeable firm like IntegriCom takes the worry off your shoulders. Contact us for a complete security assessment.

PCI Requirements

PCI DSS encompasses 6 key objectives, split across a set of 12 requirements.

The 6 Objectives Of PCI Compliance Are:

- Remove sensitive authentication data and limit data retention.

- Protect systems and networks and be prepared to respond to a system breach.

- Secure payment card applications.

- Monitor and control access to your systems.

- Protect stored cardholder data.

- Finalize remaining compliance efforts, and ensure all controls are in place.

PCI compliance is a rigorous set of standards designed to safeguard sensitive payment card information. By focusing on data protection, network security, access control, and vulnerability management, PCI compliance helps organizations prevent data breaches and maintain customer trust. Adhering to these objectives requires an approach that covers everything from securing applications to regularly monitoring systems and implementing robust access controls.

The 12 Requirements Of PCI Compliance Are:

- Install and maintain a firewall configuration to protect cardholder data

- Do not use vendor-supplied defaults for system passwords and other security parameters

- Protect stored cardholder data

- Encrypt transmission of cardholder data across open, public networks

- Use and regularly update anti-virus software or programs

- Develop and maintain secure systems and applications

- Restrict access to cardholder data by business need to know

- Assign a unique ID to each person with computer access

- Restrict physical access to cardholder data

- Track and monitor all access to network resources and cardholder data

- Regularly test security systems and processes

- Maintain a policy that addresses information security for all personnel

Our Process Is Proven By Decades Of Client Success

IntegriCom makes the investment in high-end technology that many smaller managed IT services firms choose not to make. This technology provides a dependable framework within which we operate—a structure that ensures our efforts for you are always reliable. Done right, in less time.

We have also invested in developing strong managers and experienced technicians with more certifications and skills than you will ever find in one person or a small, internal IT department. Our people know how to drive our process in order to add value to your technology, and thus to your business.

As illustrated by our Process Lock, we listen to you, analyze your needs, deploy solutions, and resolve all issues. Then we continuously repeat that process as we manage your IT. You have our ongoing support as we monitor and secure your systems, and as we meet with you to review and plan for the future.

Lock in your own peace of mind. Give us a call to see how we can meet your needs.

PCI Compliance FAQS

Frequently asked questions about PCI compliance for your business

Who Does PCI DSS Apply To?

The PCI DSS applies to all entities that process, accept, transmit, or store payment card information – basically any entity involved in card payment processing.

If you accept debit cards, prepaid cards, or credit cards online, over the phone, or in-person to receive payment, then PCI DSS applies to you—even if you do not store card data.

What Happens When You Fail PCI Compliance?

Failing PCI compliance means you could face financial penalties, legal action, damaged reputation, and loss of revenue. Increased transaction fees could be applied, or you could even lose your relationship with your bank, the credit card companies, and the payment processors you use who will not want to work with a non PCI complaint organization.

What Are The Most Common PCI Violations?

First, many organizations make the mistake of thinking PCI compliance does not apply to them.

Remember that PCI compliance applies to any organization accepting card payments. It is important to have all the controls in place, and it is wise to hire an IT Managed Services Provider to help you get and maintain PCI compliance. PCI compliance isn’t a one-time exercise but rather an ongoing diligence.

Second, many mistakenly do not segment their card processing network from the rest of their data network.

There must be network separation between your card processing network and all other networks, like the employee data network.

A third mistake businesses make is not changing from vendor’s default credentials.

It is imperative that a unique username and password is set up for your card processing technology and that it is not left with the factory default settings.

Other mistakes include negligence with the annual assessments or audits and keeping up and documenting changes.

It is important to say on top of things and keep things controlled over time as they change. It is also important to protect credentials and encryption keys and to change them periodically.

Can I Do PCI Compliance Myself?

Determining whether your business is PCI compliant requires a thorough assessment of security practices every year. Although the PCI compliance requirement is universal, validation requirements and assessments may be slightly different, depending on the card network. The type of annual assessment required depends on a few factors, including the volume of card transactions.

To become PCI compliant, a business typically must do three things:

- Meet the requirements set out by the Payment Card Industry Security Standards Council.

- Complete an assessment that shows how secure a business’s systems and practices are. Most small businesses can perform a self-assessment.

- Perform a scan of the network used to process payments. This technical exercise requires the help of an outside firm.

To ensure that you are properly compliant, reach out to a qualified & knowledgeable IT managed services provider.

Our PCI Compliance Experts Are Here To Answer Your Questions

Partner with IntegriCom, a trusted local IT support company for accountants, banks, and financial services companies with the experience and expertise to advise you on your day-to-day technology challenges.